QuickBooks Payroll

QuickBooks Payroll Services

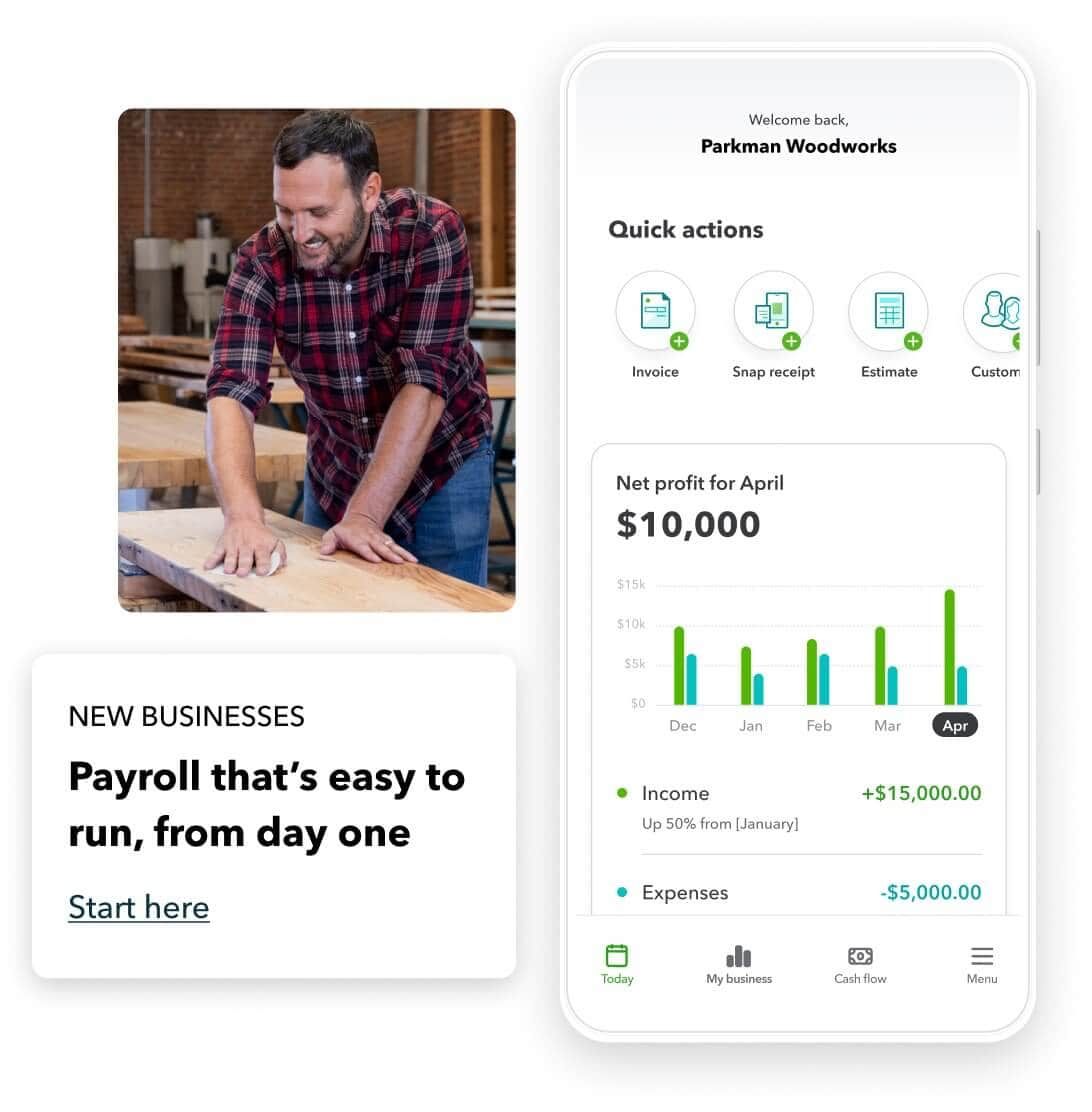

Want to use QuickBooks Payroll?

Take advantage of QuickBooks Auto Payroll. This cloud-based payroll software from one of the most trusted names in accounting software comes with automatic payroll, abundant reports and fast direct deposits.

PNATC personalizes our QuickBooks bookkeeping services in accordance with the specifics of your company.

QuickBooks Bookkeeping Services with PNATC

Yes. Full-service payroll is included in each and every plan for QuickBooks Online Payroll. This indicates that in addition to having your paycheck processed automatically, you will also obtain full-service features.

Tax filing and form filling that is automated. Calculation, filing, and payment of your federal and state payroll taxes, as well as your year-end filings, are handled on an automated basis.

Portal for the workforce. Online access to pay stubs and W-2s, as well as protected views of PTO balances and withholding allowances, are available to employees.

Setup support. Your payroll setup will be reviewed by a QuickBooks pro if you subscribe to Payroll Premium. Users of Payroll Elite have the option to have their payroll setup completed for them.

Protection from the tax penalty. Regardless of who was at fault, if you use QuickBooks Payroll Elite and the Internal Revenue Service assesses a penalty for failure to pay payroll taxes, we will pay any fines that arise, up to a maximum of $25,000.

Human resources and customer service. With QuickBooks Online Payroll Elite, you may get assistance from an HR consultant and receive expert product support around the clock.

What We Cover

How does QuickBooks Payroll work?

QuickBooks Payroll is a piece of payroll software that operates in the cloud and enables companies to pay their employees, file payroll taxes, and handle employee benefits and HR all in one location. QuickBooks will automatically calculate, file, and pay all federal and state payroll taxes, saving you a considerable amount of time.

After getting everything

set up with QuickBooks, you will be able to automatically process payroll for your staff. You also have the option of manually processing payroll using either your PC or the mobile app if you do not choose to use the automated option. You have the ability to

personalize reports in a number of different ways, including deductions and contributions, various work sites, and paid time off.

QuickBooks Online Payroll Pricing

Core

- Payroll processing that is quick and endless

- Calculate both the paychecks and the taxes.

- Tax preparation and filing through electronic means.

- Portal for the workforce

- Easily accessible in all fifty states.

- Take responsibility for garnishments and deductions.

- Reports on the payroll

- Auto Payroll

- 1099 E-File & Pay

- Expert product support

- Next-day direct deposit 401(k) plans

Premium

- Payroll processing that is quick and endless

- Compute both the paychecks and the taxes.

- Tax preparation and filing through electronic means.

- Portal for the workforce

- Easily accessible in all fifty states.

- Take responsibility for garnishments and deductions.

- Reports on the payroll

- Auto Payroll

- 1099 E-File & Pay

- Expert product support

- Same-day direct deposit

- 401(k) plans

- Contrast the various health care plans.

- Expert review

- Monitor your progress in real time.

- HR support center

- administration of workers' compensation benefits

Elite

- Payroll processing that is quick and endless

- Compute both the paychecks and the taxes.

- Tax preparation and filing through electronic means.

- Portal for the workforce

- Easily accessible in all fifty states.

- Take responsibility for garnishments and deductions.

- Reports on the payroll

- Auto Payroll

- 1099 E-File & Pay

- Expert product support

- Same-day direct deposit

- 401(k) plans

- Contrast the various health care plans.

- Expert review

- Monitor your progress in real-time.

- HR support center

- administration of workers' compensation benefits

- Abatements of Tax Penalties

- Human Resources expert on retainer

QuickBooks Payroll Benefits

Next-day and Same-day direct deposit

The QuickBooks Payroll Core plan, which is the company's most basic product, differentiates itself from similar plans offered by competitors by providing free direct payments on the following business day. When you upgrade to the Premium or Elite plan, your employees are eligible for free same-day direct deposit, which is a perk that some of our competitors do not offer at all. Your small business will be able to keep that cash on hand for a longer period of time if the turnaround time for direct deposits is rapid. This is perfect for cash-flow management.

Automatic Payroll

Every QuickBooks Payroll package includes the ability to automatically process payroll for salaried employees who are paid via direct deposit as well as hourly employees who are paid via direct deposit and have default hours set. You will receive a preview email with the option to make modifications each and every pay month before the paycheck is processed. QuickBooks Payroll will send you a confirmation text message when each of your employees has been paid.

Integrations for QuickBooks (QB)

There is an integration between QuickBooks Payroll and QuickBooks Online, which ensures that accounting data is instantly updated with payroll. Because of this, you won't need to export the information about your payroll by hand and run the risk of making mistakes while doing so. Any QuickBooks Payroll plan can have QuickBooks Online plans added to it, and vice versa.

QuickBooks Time is a feature that is included with the Premium and Elite versions of QuickBooks Payroll. It enables employees to clock in and out using their smartphones. A geofencing function is included in the Elite plan, which alerts employees to clock in and out based on the times that they arrive at and depart from a work location, respectively. For project-based businesses like landscaping companies, where staff work in multiple locations depending on the project, this feature might be helpful for task costing. Other examples of project-based businesses include construction and engineering firms.

QuickBooks Accuracy Guarantee

There is a 100% accuracy guarantee included with each and every QuickBooks Payroll package. In the event that a user supplies appropriate information on time but something still goes wrong, QuickBooks will be responsible for paying any applicable payroll tax penalties.

The Elite plan goes one step further and covers up to $25,000 annually in payroll tax penalties that may have been incurred as a result of errors that may have been made by an employer. To put it another way, you won't lose any money even if QuickBooks wasn't the one who made the mistake.

Our Core Values

At PNATC, our client's success is our biggest priority. We provide solutions that promote growth and meet your unique business objectives. Our primary core values are designed to reflect our passion for providing an excellent customer and client engagement experience.

Provide Solutions

We empower our customers to digitally transform their businesses

Strategy

We provide tangible results through our consulting and software implementation services

Focus

We stay humble, working as a team, hungry to grow, and intelligent being socially aware and intuitive to others' needs.

Achieve Success

With Innovation, identifying the best solution. Collaboration, using team resources, Implementation, exceeding expectations and delivering solutions.

PNATC is an Intuit Premier Reseller and partner. We provide expertise on all Intuit products including QuickBooks Pro, Premier and Enterprise, QuickBooks Point of Sale offerings, and Intuit Field Service Management ES. We are able to offer the lowest prices you can find on all QuickBooks products.

You’re In Good Company

See Our Reviews Online

Working on projects with Joshua at PNATC has been a fantastic experience! Josh knows his stuff. The folks at PNATC not only know the technology, they are expert accountants and understand all things finance. Having those resources in one place is a huge advantage. And Josh is just an all-around great person, easy to get along with.

Max Tyack

P&N Client

Highly recommended accounting technology firm. It's a pleasure to work with them. Super friendly and knowledgeable staff. Josh and Scott always think out of the box to find solutions for the most complicated migrations.

Meir Stauber

P&N Client

Great firm. I work with them and recommend them to all of my clients. They have an amazing staff and phenomenal at taking care of Quickbooks. They go above and beyond and I often get unsolicited thank yous from the people I send their way. I would recommend them highly.

Declan Daly

P&N Client

PNATC has been teaching QuickBook and Accounting classes to SCORE members over the past 10 years. They are experts in these topic areas and have been a tremendous value to hundreds of SCORE's members. Truly an outstanding base of knowledge! Kristin Cavataio and Andy Presti are top notch.

Kendra Anderson

P&N Client

Josh is my No 1 person to go to with any question re Zoho Inventory. Not only is he knowledgeable, he is quick to help and excellent at explaining complex processes in a simple digestible manner. Would recommend PNATC and their team esp Josh.

Meeta Gargav

P&N Client

contact PNATC Accounting Technology Consultants

Get More with QuickBooks Payroll, Contact us for a free Consultation

Home - Website lead

We will get back to you as soon as possible.

Please try again later.

Contact Information

(203) 489-9887

Office Locations

225 W 35th St, Suite 5B New York, NY 10001

350 Bedford St., Suite 303 Stamford CT 06901

About PNATC

QuickBooks

QuickBooks Services

All Rights Reserved | PNATC | Privacy Policy | Terms and Conditions